The ten domains of family wealth

Key points

What is the issue?

A new model released by the recently formed UHNW Institute may be transformative for family businesses.

What does it mean for me?

The Ten Domains of Family Wealth (the Model) outlines a comprehensive, integrated understanding of family wealth for those advising ultra-high-net-worth individuals.

What can I take away?

Advisors should anticipate that families will be keenly interested in the Model and its utility for evaluating service offerings.

A new model by the recently formed UHNW Institute may be as transformative as the Three-Circle Model has been for family businesses.1 The Ten Domains of Family Wealth (the Model) outlines a comprehensive, integrated understanding of family wealth for ultra-high-net-worth (UHNW) families, their advisors and the wealth management industry.

The genesis of the Model

Wealthy families and advisors in attendance at a 2018 US family office summit expressed several common frustrations with existing wealth management models:

- overarching confusion about advisory business models;

- a general lack of transparency; and

- a shortage of conflict-free, unbiased education.

In response, the UHNW Institute was established as a non-profit think tank to educate and assist UHNW families and family offices in selecting and working with wealth managers, and to support evolutionary, sustainable change and professional development within the UHNW industry itself.

As its inaugural project, a team of senior executives and industry veterans tackled the deceptively simple question of what the full landscape of UHNW family wealth actually comprises. A process of information-gathering, reflection and dialogue over many months culminated in the Model.2

The Model pulls together the array of complex, disparate services needed to integrate a family’s financial and non-financial balance sheets, encouraging families and advisors to move beyond professional boundaries and organise their work in better ways to deliver services to families in a holistic fashion.

A conceptual road map for advisors and families

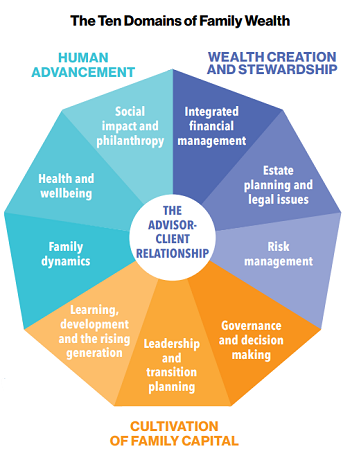

The Model helps to outline the range of knowledge, skills and services required to help UHNW families flourish. It identifies nine technical, or content, domains along with one central organising domain focused on the processes common to delivering services in any technical area.

The advisor-client relationship – at the centre of all services

The advisor-client relationship lives at the core of the Model, emphasising its unifying role within and across all services. It emphasises the benefits of integration and collaboration as prominent values for the team advising the UHNW client and family.

Advisors who excel in UHNW services have a distinctive knowledge base that includes:

- understanding the pivotal role of advisors in the personal aspects of clients’ lives;

- understanding collaborative approaches;

- appreciation of the complex ethical, business and professional issues that can arise in working with families; and

- knowledge of the important cross-cultural elements present within global families.

The Model also sets out comprehensive skills advisors should have, including good communication skills, building and maintaining trust in the client relationship, avoiding excessive jargon and even minimising biases when working with ultra-wealthy clients.

The nine specialty domains

The advisor-client relationship serves three broad clusters of specialty areas, each comprising three domains. The main elements are listed below.3

Wealth creation and stewardship

- Integrated financial management: financial planning; integrated wealth and asset management; financial elements of insurance, taxation, legal and risk management; back-office technology; pricing and business models.

- Estate planning and legal issues: trusts, partnerships and other legal entities; ownership rights and control; integrated estate planning; family law related to wealth and philanthropy; mental or physical incapacity; legal matters and tax planning in service of wealth transfer strategies.

- Risk management: integrated risk management and insurance planning across a range of roles including family governance; assessment and management of geopolitical, technology/cybersecurity, staffing and household risks.

Cultivation of family capital

- Governance and decision-making: communication, decision-making and conflict management procedures for families and family enterprises; owner/shareholder roles, responsibilities and agreements; family enterprise governance structures, processes and procedures.

- Leadership and transition planning: leadership roles and responsibilities in families and family enterprises; assessment, planning and implementation of succession and transition planning.

- Learning, development and the rising generation: raising children with wealth; education about ownership, financial skills, governance and support for next generation growth and development.

Human advancement

- Family dynamics: adjustment of individuals, couples and families related to wealth and family business; family conflict issues and ethnic, geographic, spiritual and cultural considerations.

- Health and wellbeing: demographic, health and longevity trends affecting families; impact of dementia, substance abuse and other disorders within the family and family enterprise; concierge and global health services.

- Social impact and philanthropy: impact investing and philanthropic activities directed at social and community well-being; family foundations, donor-advised funds and other philanthropic vehicles; sustainability and social responsibility guidelines, practices and programmes.

No single advisor is required to fulfil all needs in all domains for client families. The domains simply represent the full landscape of what families need and what their advisors should be able to serve either in-house, on referral or via collaboration. It is the need for capable integration across the client’s team that is critical to effective service delivery.

The opportunity for advisors

Families are increasingly sophisticated in their prospecting efforts and willingness to share knowledge among their peers. Advisors should anticipate that families will be keenly interested in the Model and its obvious utility for evaluating service offerings. Expect families to push back against traditional or outmoded service delivery models built on ‘silos’ in favour of advisors who are more collaborative and family-centric, not advisor-centric.

Seasoned advisors in global wealth management and related fields will inevitably be challenged to compare their knowledge and skill sets to the domains outlined in this new framework. Although not needing to be fully expert in all areas, they may need further training in probing and planning for any areas where they lack even basic knowledge. Similarly, few firms may want to offer services in all areas, though all firms must up their game with modern approaches to client relationship skills. Firms will want to make strategic decisions about which domains to emphasise in-house and which to offer on a referral basis with skilled partners. But families will ask more intelligently about the menu available, so be prepared.

Advisors with skills for the new world of integrated, collaborative service will be preferentially rewarded in the expanding marketplace of global wealth.4

Read more

The STEP Business Families Special Interest Group has developed a reference guide for STEP members containing operational, governance, tax and succession discussion points for use with business family clients to help mitigate the impact of COVID-19. Find out more

- 1R. Tagiuri and J. A. Davis, ‘Bivalent Attributes of the Family Firm’, working paper, Harvard Business School, Cambridge, MA (1982), reprinted in Family Business Review, 9:2 (1996), pp.199–208

- 2Copyright UHNW Institute, used with permission.

- 3A comprehensive list of specific advisor capabilities for each content domain is provided and illustrated in a comprehensive case study at bit.ly/38gbf1B

- 4The author would like to thank James Grubman PhD TEP, Chair of the UHNW Institute’s content and curriculum board, for his significant contribution to this article.

Connect with us